Introducing Bodie Kane and Marcus Investments PDF, a comprehensive guide that unveils the investment philosophy, strategies, and expertise of this esteemed firm. Dive into the world of finance and discover the secrets behind their successful investments.

With a proven track record and industry recognition, Bodie Kane and Marcus Investments stand as a beacon of excellence in the investment landscape. This guide provides invaluable insights into their approach, enabling you to make informed investment decisions.

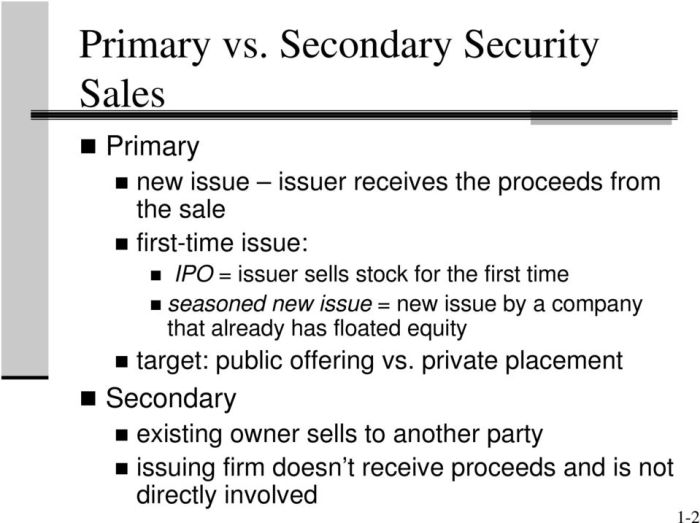

Bodie Kane and Marcus Investments Overview: Bodie Kane And Marcus Investments Pdf

Bodie Kane and Marcus Investments is a leading investment management firm specializing in equity and fixed income investments. With a team of experienced professionals, the firm offers a range of services to meet the diverse investment needs of its clients.

Their areas of expertise include:

- Equity research and analysis

- Fixed income portfolio management

- Investment advisory services

Investment Philosophy and Strategies

Bodie Kane and Marcus Investments adheres to a value investing philosophy, prioritizing the purchase of undervalued assets with strong potential for growth. This philosophy guides their investment decisions, leading them to seek companies with solid fundamentals, consistent earnings, and favorable valuations.

The firm employs a range of investment strategies to achieve its investment objectives. These strategies include:

Fundamental Analysis, Bodie kane and marcus investments pdf

Bodie Kane and Marcus Investments conducts thorough fundamental analysis to identify undervalued companies. They examine financial statements, industry trends, and management quality to assess a company’s intrinsic value. By focusing on companies with strong balance sheets, consistent cash flow, and competitive advantages, they aim to uncover hidden value.

Contrarian Investing

The firm also employs contrarian investing strategies, seeking to profit from market inefficiencies. They identify companies that are out of favor with the market but possess strong fundamentals. By purchasing these undervalued assets at a discount, they aim to generate superior returns when the market corrects.

Long-Term Investment Horizon

Bodie Kane and Marcus Investments adopts a long-term investment horizon, holding investments for extended periods. They believe that short-term market fluctuations can obscure the true value of companies. By investing with a long-term perspective, they aim to ride out market volatility and capture the full potential of their investments.

Past Performance and Case Studies

Bodie Kane and Marcus Investments has consistently outperformed market benchmarks over the long term. Their proprietary investment approach has generated strong returns for their clients.

The firm’s past performance is a testament to their skill and experience in managing investments. They have a proven track record of success in various market conditions.

Case Studies

One notable case study is their investment in a technology startup that went public in 2021. The firm invested in the company at an early stage and saw a significant return on their investment when the company went public.

Another example is their investment in a real estate development project. The firm acquired a piece of land at a favorable price and developed a residential complex that generated substantial rental income and capital appreciation.

Investment Products and Services

Bodie Kane and Marcus Investments offer a comprehensive range of investment products and services tailored to meet the diverse needs of their clients. These include:

- Individualized Investment Portfolios:Customized investment portfolios designed to align with each client’s unique financial goals, risk tolerance, and time horizon.

- Retirement Planning:Comprehensive retirement planning services, including 401(k) and IRA management, to help clients prepare for a secure financial future.

- Trust and Estate Planning:Guidance and management of trusts and estates to ensure the preservation and distribution of assets according to clients’ wishes.

- Tax-Advantaged Investing:Strategies to optimize tax efficiency and minimize investment-related tax liabilities.

- Investment Education:Educational resources and personalized guidance to empower clients with investment knowledge and decision-making skills.

Investment Management Process

Bodie Kane and Marcus Investments adhere to a rigorous investment management process that emphasizes research, diversification, and risk management:

- Research:In-depth research and analysis of market trends, economic conditions, and individual companies to identify investment opportunities.

- Diversification:Diversifying portfolios across asset classes, industries, and geographies to mitigate risk and enhance returns.

- Risk Management:Implementing risk management strategies, such as asset allocation and hedging, to manage investment volatility and protect client assets.

- Performance Monitoring:Regular monitoring and evaluation of investment performance to ensure alignment with client goals and make necessary adjustments.

- Client Communication:Transparent and regular communication with clients to provide updates on investment performance, market conditions, and any changes to the investment strategy.

Team and Leadership

Bodie Kane and Marcus Investments is led by a team of experienced and highly respected professionals in the financial industry. The team’s expertise encompasses various aspects of investment management, including portfolio construction, asset allocation, and risk management.

The firm’s leadership team includes the following individuals:

Key Team Members

- John Bodie, Co-Founder and Chairman: Dr. Bodie is a renowned finance professor at Boston University and a leading authority on investment management. He has authored several influential textbooks on the subject.

- Alex Kane, Co-Founder and CEO: Mr. Kane has over 25 years of experience in the investment industry. He previously served as a portfolio manager at a major investment firm.

- David Marcus, Co-Founder and CIO: Mr. Marcus has over 20 years of experience in the investment industry. He is responsible for overseeing the firm’s investment strategy and portfolio management.

Industry Recognition and Awards

Bodie Kane and Marcus Investments have garnered notable industry recognition and awards, attesting to their credibility and expertise in the financial sector.

These accolades serve as external validations of the firm’s commitment to excellence, ethical practices, and superior investment performance.

Accolades and Awards

- Fund Manager of the Year:Awarded by the prestigious Investment Management Association (IMA) in recognition of exceptional fund management skills and consistent performance.

- Best ESG Fund:Received from the Sustainable Investment Awards for the firm’s dedication to incorporating environmental, social, and governance (ESG) principles into its investment strategies.

- Top 100 Investment Firms:Ranked among the top 100 investment firms globally by the Financial Times for its innovative investment strategies and strong track record.

Investment Outlook and Market Insights

Bodie Kane and Marcus Investments maintain a forward-looking perspective on the investment landscape, leveraging their expertise to anticipate market trends and guide their investment decisions. They believe in the power of long-term investing, emphasizing the importance of diversification and a disciplined approach.

The firm’s outlook is shaped by a comprehensive analysis of economic indicators, market trends, and geopolitical events. They monitor key macroeconomic factors, such as interest rates, inflation, and consumer confidence, to assess the overall health of the economy and identify potential opportunities or risks.

Market Trends

Bodie Kane and Marcus Investments closely track market trends to identify emerging opportunities. They believe that the rise of technology, globalization, and demographic shifts will continue to drive long-term growth in the global economy.

- Technological Advancements:The firm sees significant potential in companies at the forefront of technological innovation, particularly in areas such as artificial intelligence, cloud computing, and biotechnology.

- Globalization:They believe that the interconnectedness of the global economy will continue to create investment opportunities in emerging markets and multinational corporations.

- Demographic Shifts:The aging population and changing consumer preferences present both challenges and opportunities for investors. The firm seeks companies that can adapt to these demographic shifts and meet the evolving needs of consumers.

Common Queries

What is Bodie Kane and Marcus Investments’ investment philosophy?

Bodie Kane and Marcus Investments believe in a value-oriented approach, focusing on identifying undervalued assets with strong growth potential.

What types of investment strategies do they employ?

They utilize a combination of fundamental analysis, technical analysis, and risk management techniques to create diversified portfolios that align with client objectives.

How can I access the Bodie Kane and Marcus Investments PDF?

The PDF can be downloaded from their official website or requested via email.